Gold and silver prices plunged on Friday, January 30, as investors reacted to US President Donald Trump’s nomination of a new Federal Reserve chair. European stock markets closed the week on a positive note, while Wall Street edged slightly lower.

The sell-off in precious metals followed reports—later confirmed—that Trump had chosen former Federal Reserve official Kevin Warsh to replace Jerome Powell as head of the US central bank. Trump announced the nomination on his Truth Social platform, calling Warsh “one of the GREAT Fed Chairmen, maybe the best,” and praising his reliability and presence.

Kathleen Brooks, research director at XTB, described the choice as “an interesting pick… that may give the market some hope that Fed independence will be preserved.” Investor concerns had risen after Trump’s repeated criticisms of Powell, whose term ends in May, with fears that political interference could undermine the Fed and increase inflation risks.

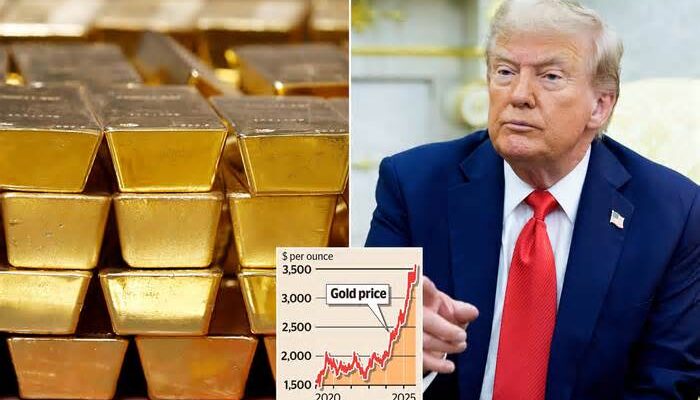

Safe-haven assets, which had surged earlier in the week amid uncertainty over Trump’s policies, fell sharply. Gold dropped more than eight percent to below $5,000 an ounce after hitting a record $5,595.47 on Thursday, while silver fell roughly 20 percent to trade near $90 an ounce, down from an all-time peak above $120.

Financial markets experienced a volatile week, driven by a weaker US dollar, renewed tariff threats from Trump, rising tensions with Iran, and concerns about a potential US government shutdown. Asian markets closed the week lower after a technology-led sell-off on Wall Street. Early optimism from strong earnings at companies such as Meta, Samsung, and SK Hynix was tempered by Microsoft’s announcement of sharply increased spending on AI infrastructure, sparking fears that returns on heavy AI investment may take longer to materialize and that valuations could be stretched after years of tech-driven gains.

Oil prices recovered from early losses on Friday after surging the previous day amid escalating rhetoric from Trump towards Tehran. Megan Fisher, assistant economist at Capital Economics, said tensions between Iran and the US had pushed Brent crude to a six-month high. She added, however, that historical precedent—including last year’s brief US-Iran-Israel conflict—and ample global oil supply are likely to limit price increases by the end of 2026.